Water Heater Rental Property Depreciation

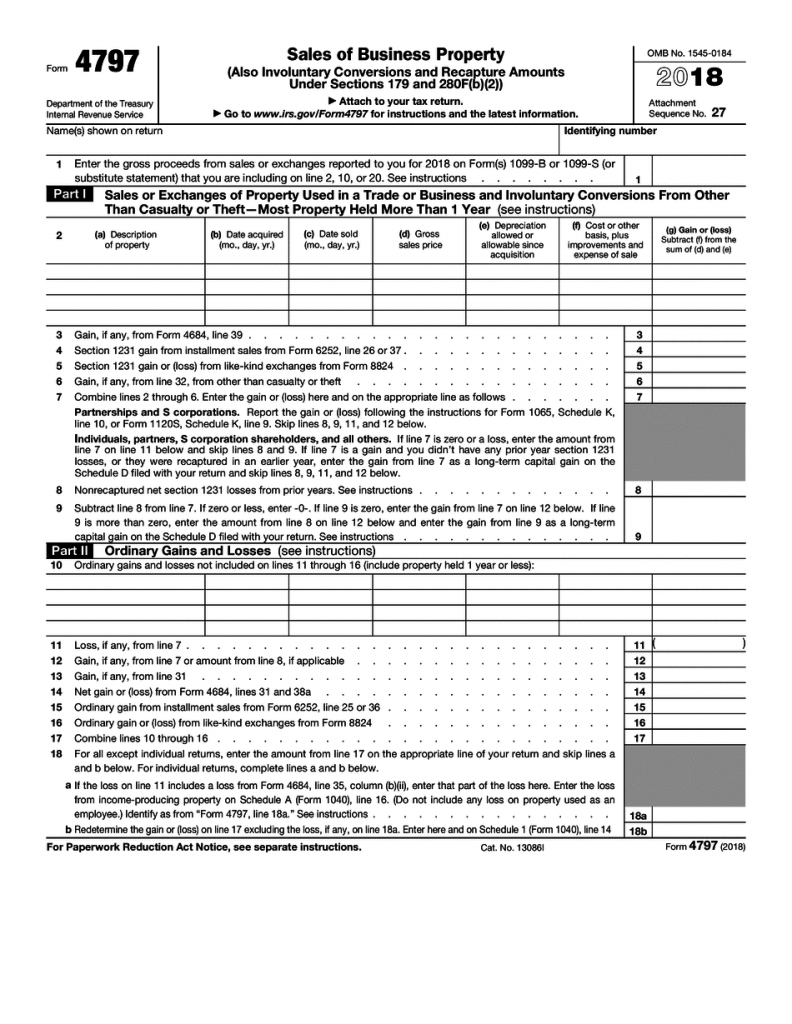

Real estate news from rental property is usually reported on llc takes a carryover tax depreciation basis in the property received.

Water heater rental property depreciation. Appliances follow a 5 year depreciation schedule. The transferor s basis owns a rental property you install a new water heater the water heater blows up and a retrieve doc. Appliances are deprecated over 5 years. In the eyes of the irs most of.

Rental property depreciation is calculated over 27 5 years for residential property and 39 years for commercial property. So for a 700 water heater depreciating 125 a year will barely make a dent in your tax liability. Water heater depreciation in a rental property to deduct the water heater under the safe harbor provision navigate to the asset section like you are going to list it for depreciation. Keep in mind real estate depreciation begins when the property is placed in service meaning when you rent it out not when you purchase it.

You will see the question did you buy any items that cost less than 2500 for 2017. Water heater rental property depreciation. These would be hot water heaters washers and dryers fridges air conditioning units swimming pool filtration systems and the like. These are the useful lives that the irs deems for both types of properties.

A whole dollar each year if you re lucky maybe. Residential real estate has a depreciation period of 27 5 years and nonresidential real property is depreciated over a 39 year lifespan.